Money and Financial Planning Don’t Have to be Taboo Topics in Your Home

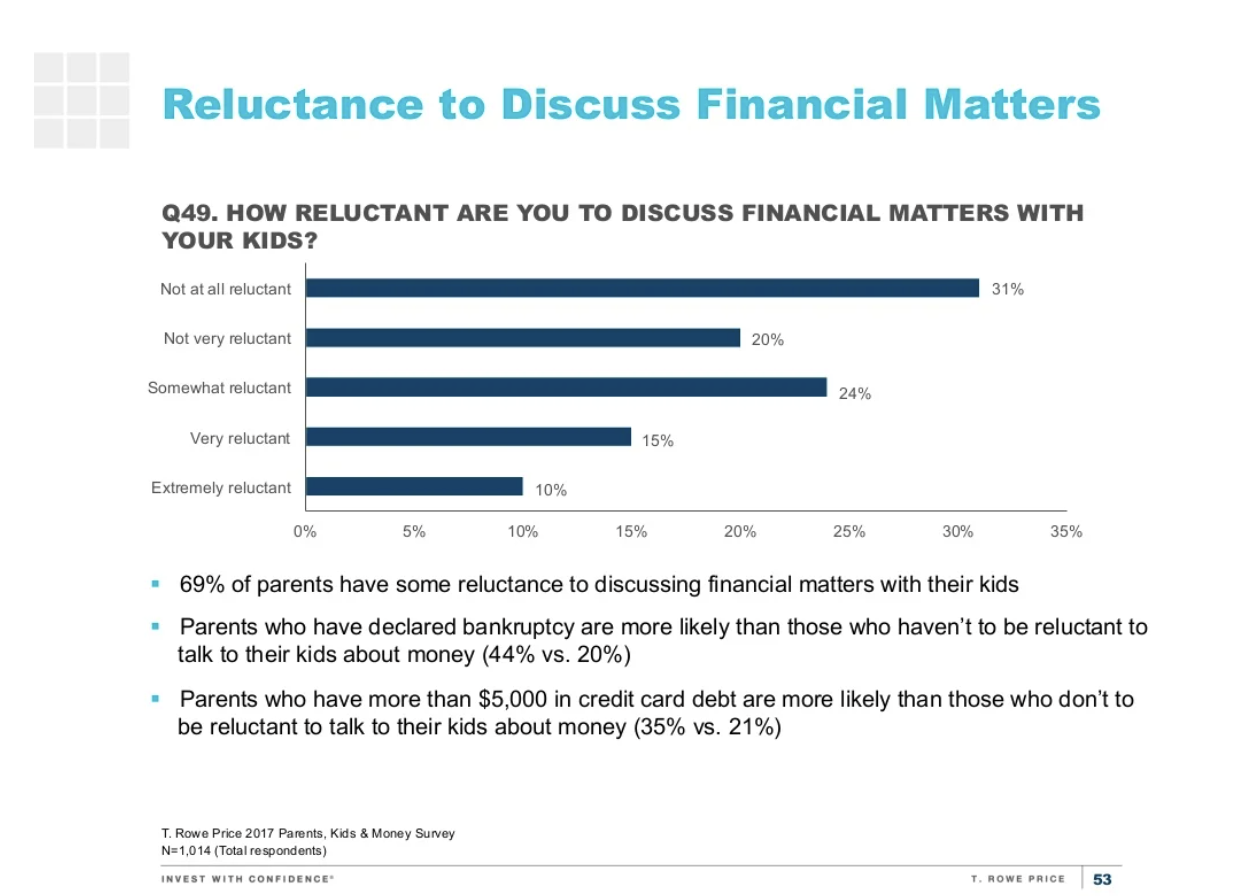

For many, money is a taboo subject that shouldn’t be talked about. According to T. Rowe Price’s 2017 Parents, Kids & Money Survey, 69% of parents have at least some reluctance talking to their kids about money and finances.

It seems that discussing how much money you make or have is worse than people seeing you naked. I agree that not everyone you encounter should know about your financial situation, but people often take this idea too far, to the point that even their immediate family members don’t know about their finances. I’ve worked with couples where each person didn’t know the other’s income, savings or spending habits. And money is also a taboo for many parents with their children. Some parents feel that their children have no business knowing about their finances, and therefore, stay mum on the subject, even when children ask. I grew up in a house like this. Most people do.

“So what?” you ask. All this secrecy almost always leads to conflict between spouses, so finances become one of the top reasons for divorce. It’s as if our partner isn’t trustworthy enough to know about this facet of our lives. We shut down and there’s no communication about money and the role it should play in our families.

And when it comes to children, this mindset is even more bizarre. We say that we want the very best for our kids. The best experiences, the best education, the best care. Yet we’re not willing to teach them one of the most important life skills to lead productive, stress-free lives. Many kids grow up not knowing how money works. They fail to learn that compound interest cuts both ways. So they spend decades learning financial lessons the hard way. They have the same relationship to money that was modeled to them. Secrecy, money problems, conflicts. And the cycle repeats all over again.

It doesn’t have to be this way.

So what’s the solution? For starters, a review of your money history will give you tremendous insight into the money messages that consciously and subconsciously influence how you deal with money issues today. Remember, awareness is the first step to change. Here are some questions to consider.

Was money a source of conflict between your parents?

Did the adults in your life demonstrate responsible or irresponsible money behavior?

Was money used as a way to control you or to make you feel inferior?

Was money considered the dad’s domain?

BTW, these revelations are not intended to place blame on anyone, but rather to help you recognize the obstacles to your financial wellness. We can then work on rewiring unhelpful thoughts and feelings about money that form the foundation to whatever change is needed.

Reviewing your money history is just one part of our personalized discovery process, the first step in creating a financial life plan tailored to your family’s specific needs. And if it turns out that you’re part of that group who is reluctant to share financial info with your partner or kids, that’s OK. No judgment here. But if you want to do something to change that, that’s what we’re here for.

If you’re ready to break the cycle and learn healthy ways of discussing money and financial issues with your spouse and kids, we’d love to help. Click below to schedule a free intro call to learn more about how we can work together.