Busting the Traditional vs Roth Myth

The deadline to make your 2022 Traditional IRA or Roth IRA contribution is right around the corner. Like always, you procrastinated and are now rushing to make your contribution before April 18. You do a quick Google search on what type of contribution is best, but you get conflicting information. Some argue that Traditional is better because the whole contribution gets to grow tax-deferred before you have to pay any taxes on it. Others, including a well-known radio host whose last name rhymes with Shmamsey, say Roth is always better because “the entire growth will be tax-free.” In this post, I want to clear up the confusion from a tax perspective of choosing between the two.

While both of the arguments above are true, they fail to highlight a very important point: it doesn’t matter if the growth happens pre-tax or after tax (this is going to be blasphemy to Mr. Schmamsey fans, but it’s true). What matters is your tax rate now versus what it’ll be in the future.

I’ll use a fun example to make the point. Assume that you contribute the 2022 maximum ($6,000) to your Traditional IRA, and that amount grows at an 8% annualized return for 25 years. With Traditional IRAs, you get a tax deduction on your contribution so there is no tax upfront, but you’ll get taxed when you withdraw funds. Let’s assume your tax rate will be 25% when you withdraw. The equation to solve for your ending balance looks like this:

Contribution x Growth x Tax Hit

Now let’s assume that you’re a big fan of Mr. Schmamsey and you decide to go with a Roth IRA instead. Here, since there is no upfront deduction, you pay tax on the funds used for the contribution. Assume that after-tax amount grows at the same rate and for the same time as the scenario above. The equation for this ending value is like this:

Contribution x Tax Hit x Growth

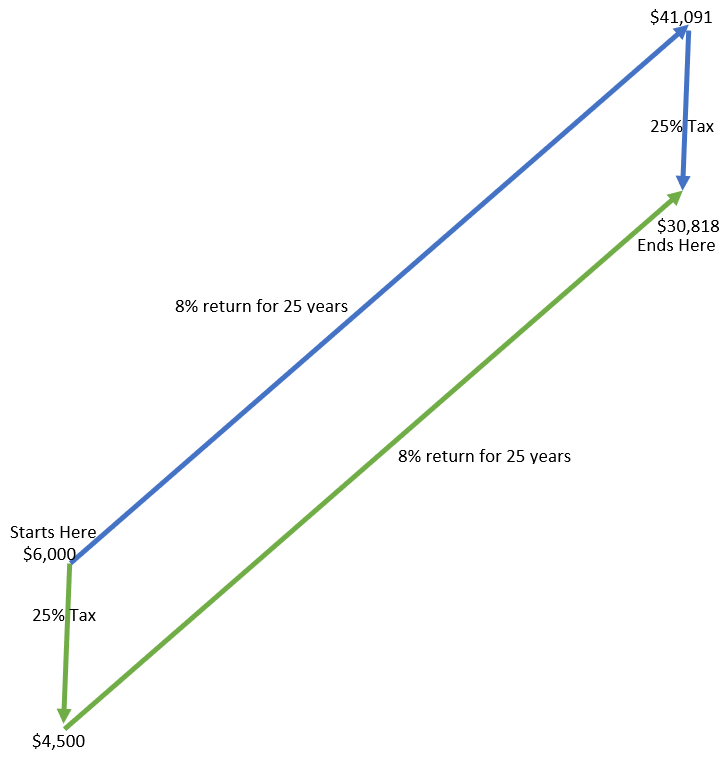

I don’t know about you, but I remember something from Mr. Stanley’s algebra class that these two equations should give us the same result. And, lo-and-behold, they do. $30,818 to be exact. For my visual learners, I got you. These scenarios look something like this:

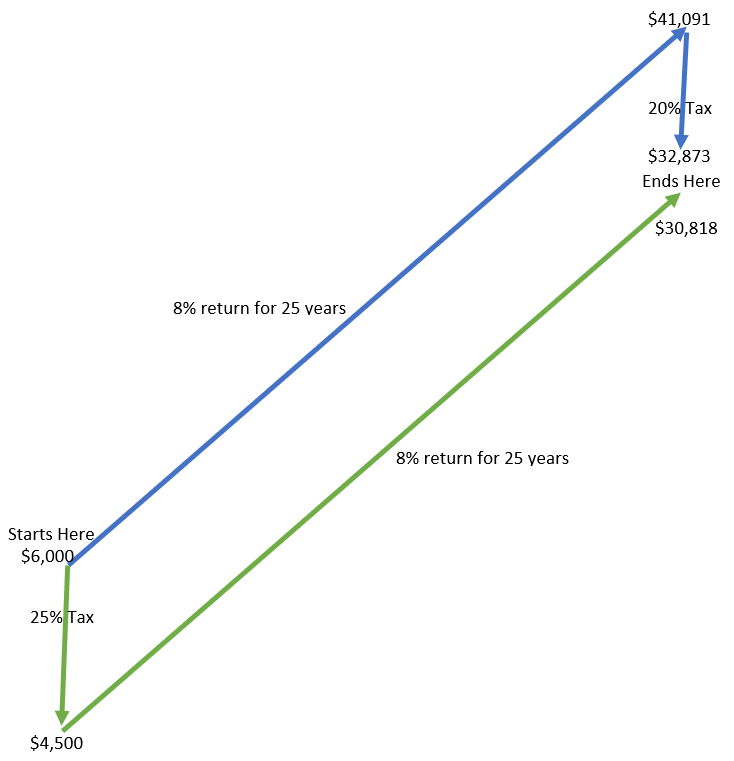

The blue path is the Traditional IRA (contribution -> growth -> tax hit), while the green path is the Roth IRA (contribution -> tax hit -> growth). Therefore, if your tax rate now is the same as the tax rate you’ll pay in the future, it really doesn’t matter what you contribute to. So, from a tax perspective, the only thing that matters when deciding between the two is what your tax rate will be now versus what it’ll be in the future. If your tax rate will be lower in the future, go Traditional. If it’ll be higher, go Roth. For example, suppose that you know for a fact that your tax rate will be lower in the future at 20% instead of your current 25% tax rate. Then the diagram looks like this:

Clearly going Traditional is better than going Roth in this example. But that is not what Mr. Schmamsey wants you to believe. He makes it seem that, under any and all circumstances, tax-free growth is better than tax-deferred growth because “most of your money in your Roth IRA will be growth.” That argument is bogus because, as can be seen by the diagrams, this is also true for the Traditional IRA. Further, for many high-earning families, they’re at very high tax rates right now and, with proper planning, could be at lower tax rates in the future.

The fact is that none of us, including Mr. Schmamsey, know what our tax rate will be in the future. Not only does our future tax rate depend on many personal financial decisions we make throughout our lives, but it also depends on future politicians, the future economy and a whole bunch of other future stuff that we have no control over.

So how are we supposed to decide which to contribute to? Well, for starters, working with a financial planner can at least give you a sense of the direction where your tax rate is heading based on your current financial decisions. Also, as a general rule of thumb, I always encourage people to have money in each tax bucket: taxable, tax-deferred (Traditional), and tax-free (Roth). That way you’ve got your bases covered regardless of what comes your way.

On a related note, I really get annoyed (my very own Dave rant!) that Roth accounts are referred to as tax-free. As seen by the equation and diagrams above, they are definitely not “tax-free.” Pre-paid tax is more appropriate.

To be clear, your current vs. future tax rate is not the only thing that needs to be considered when determining your contribution. That’s because different rules govern each type of account. For example, Traditional IRAs have Required Minimum Distributions (RMDs), while Roths don’t. Roths also allow for tax-free withdrawals of contributions after you’ve had your account for at least 5 years, but Traditional IRAs don’t. There are many considerations that a financial planner can help you sort through when it comes to choosing which vehicle is best for your investing needs.

If you’re ready to stop receiving shady financial advice from the radio, reach out! I’d love to connect.